What To Do When The Stock Market Keeps Going Up

.....Or Not Do.....

If you’ve set up your IRA, 401(k), or regular investment account and then let it run on autopilot, congratulations—you might be doing yourself a favor. Research shows that a hands-off approach often leads to better outcomes when it comes to long-term goals like retirement. Studies have demonstrated that those who constantly resist the urge to tinker with their investments tend to fare better over time. This is because the market has its natural ups and downs, and trying to outsmart it can often lead to more harm than good.

However, if you’re one of those diligent types who check their portfolio weekly—or even daily—and find yourself growing increasingly anxious as your investments keep climbing, I’ve got a few ideas that might help ease your concerns.

As a financial advisor, I employ a strategy known as strategic asset allocation with my client’s portfolios. This approach involves determining risk tolerance through various methods—conversations, questionnaires, and a thorough understanding of the client’s financial situation. Once we establish a risk threshold, we suggest an asset allocation that aligns with it. For many of my clients, this results in a 70/30 or 60/40 allocation, meaning 70% in stocks and 30% in bonds, or 60% in stocks and 40% in bonds.

A quick note: When I mention "stocks" and "bonds," I’m not necessarily referring to individual stocks or bonds. Often, these allocations are made up of ETFs (Exchange-Traded Funds) or mutual funds that pool together a broad range of investments. This approach offers more diversification and can be less risky than investing in individual securities.

So, what happens when the market causes your allocation to drift? Let’s say your 70/30 portfolio shifts to 75/25 because stocks have surged. This is where rebalancing comes into play. We sell some stocks and buy bonds to return the allocation to the original ratio. This disciplined approach achieves a few key objectives:

Buy low, sell high: We’re systematically taking profits from overperforming assets and reinvesting them in underperforming ones.

Disciplined investing: We remove emotion from the equation, ensuring that decisions are based on strategy rather than fear or greed.

Peace of mind: Knowing someone actively manages your portfolio can provide comfort, especially during volatile times.

Most custodial websites offer user-friendly graphics, like pie charts and graphs, that show your current asset allocation. This makes it easy to see whether your portfolio has drifted from its target. Before rebalancing, you can decide how far you're comfortable letting it stray.

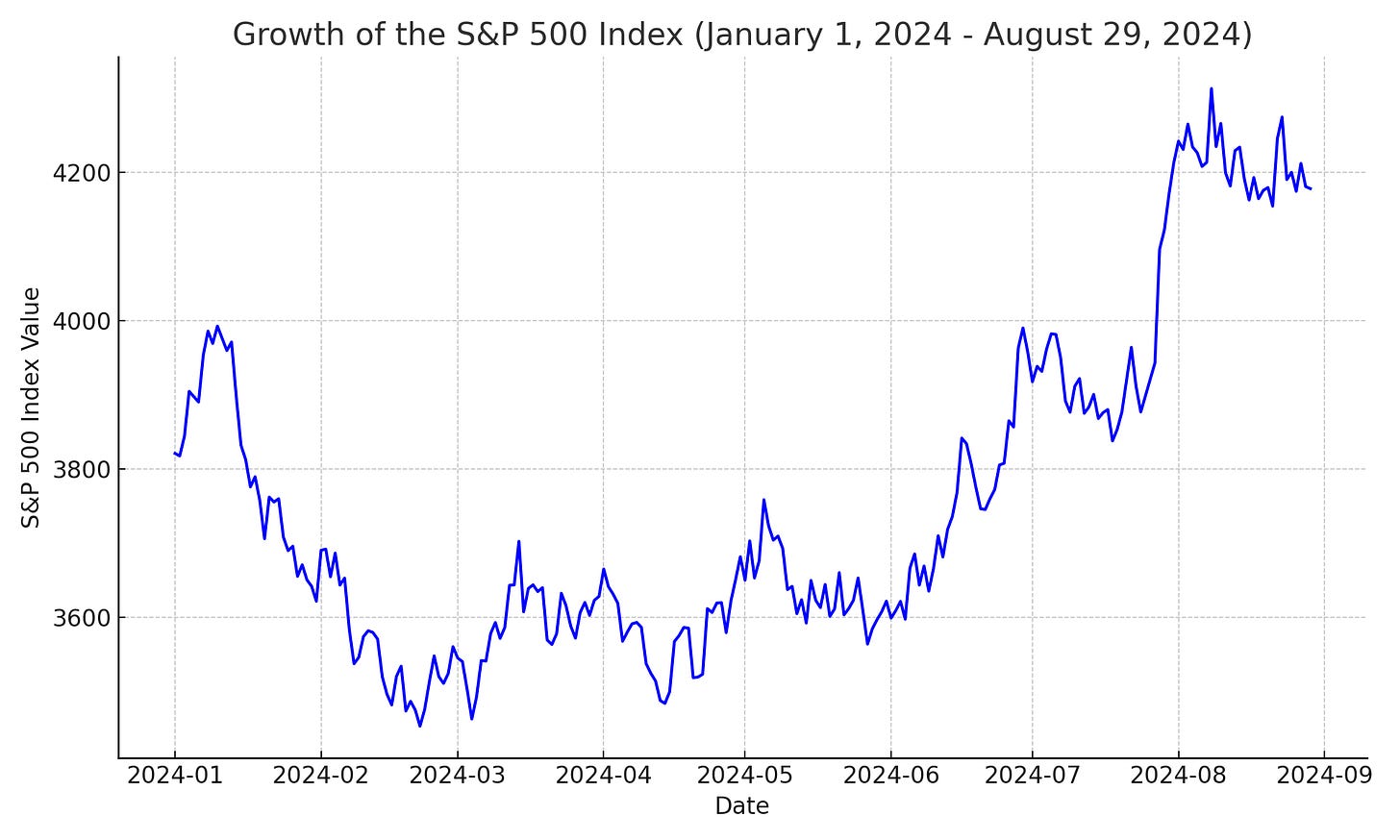

Why do we go through all this effort? If you revisit my Substack post, "What is the S&P 500 and Why You Should Care?" you'll better understand the broader market forces at work and why maintaining a balanced approach is crucial.

Disclaimer: This information is for educational purposes, not investment advice. Please consult your financial advisor or conduct additional research. Ensure that any investment aligns with your risk tolerance and timeframes.