The Luck of the Irish (and Your Financial Life)

Happy St. Patrick's Day

You’ve probably heard the phrase “the luck of the Irish”—but where does it come from?

It dates back to the California Gold Rush when a surprising number of Irish immigrants struck it rich. People started associating the Irish with financial windfalls as if they had some magical ability to stumble upon gold. Some historians say that due to the anti-Irish sentiment at the time, the phrase was originally meant as a backhanded compliment, implying that Irish success was purely accidental and not the result of hard work or skill.

Given Ireland’s long history of colonization, famine, and economic struggles, luck doesn’t seem like the right word. Resilience would be a better fit. But whether we like to admit it or not, luck plays a role in life—and in financial success.

***

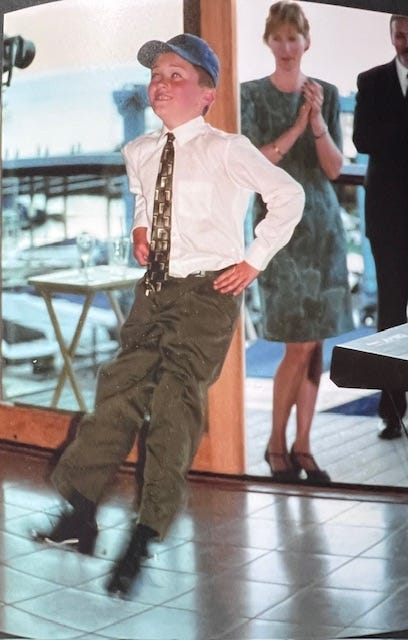

I grew up in San Francisco’s Sunset District, a neighborhood full of Irish and Italian families. I’m neither, but I might as well have been honorary Irish by proximity. Half of my Catholic school classmates were Irish. When my friends and I hit 21, we frequently visited the Irish pubs along Geary and Clement Streets. My brother married into an Irish family with deep roots in Ireland and Irish traditions, and at my wedding (a couple of decades ago), my nephew—who traveled the country competing in Irish dance—performed a jig in front of all our guests.

The Irish had a reputation for luck, but what they really had was an unshakable sense of community, a deep appreciation for celebration, and an ability to roll with life’s punches.

***

Luck plays a bigger role in financial success than people like to admit. Morgan Housel, in The Psychology of Money, talks about how random factors—where and when you were born, who you meet, even the year you start investing—can shape your financial trajectory. In Success and Luck: Good Fortune and the Myth of Meritocracy, Robert Frank argues that luck is the missing ingredient in most wealth-building stories.

Take two people who make the same smart financial decisions—one started investing in 2009, and the other in 2007. Their experiences (and portfolios) will look completely different. Right place, right time matters.

But while no one controls luck, we can set ourselves up to take advantage of it. The Irish miners in the Gold Rush didn’t just sit around waiting for gold to land in their laps—they panned, dug, and staked claims. The same idea applies to money. Hoping for a windfall isn’t a financial plan. Saving, investing, and being prepared when opportunities come along is.

***

I have recommended Morgan Housel’s book in past posts, and another great behavioral finance book is The Soul of Wealth by Daniel Crosby. Read a chapter at a time and watch your financial behavior shift for the better - with a little luck!